- IP-Exchange means to receive an incoming application and give an outgoing application in return.

- 1:1 IP-Exchange is a fair exchange pattern of 'receive in 1 application and give out 1 application.'

Definition of 'IP-Exchange' and '1:1 IP-Exchange'

What patterns of IP-Exchanges are there?

Patterns of IP-Exchanges

- Two Parties

- The IP-Exchange between two parties is limited to meet the 3 Requirements. Therefore 1:1 IP-Exchange occurs rarely.

- Many Parties [Circular]

- The IP-Exchange among many parties has a wide range of choices. IOU Website works effectively to meet the 3 Requirements. These 1:1 IP-Exchanges occur very often.

(IP-Exchange goes by two or many parties, circularly or non-circularly.)

'Profit-Sharing IP-Exchange' Pattern

[Hot Issue] Profit-Sharing IP-Exchange

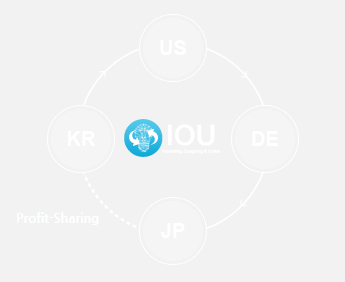

- Many Parties [Non-circular] (Profit- Sharing)

- What is the 'blind spot‘ of IP-Exchange?

- More than 70% of all IP firms in the world are small so that it is difficult for them to serve incoming applications. Even though many small IP firms send outgoing applications, they do not receive any incoming applications at all. This is called 'blind spot' in the IP-Exchange business area.

- What is the 'Profit-Sharing IP-Exchange'?

- This exchange is made to share the profit between a small firm of outgoings and a big overseas firm specialized in incomings. IOU performs always this pattern of match-making process perfectly.

- <Example; Look at the picture above.> IOU receives 3 requests for brokerage at the same time.

- ① A small Korean firm in the blind spot requests for a brokerage as a Profit-Sharing (KR to CN).

- ② A big Chinese firm requests for a brokerage as a 1:1 IP-Exchange (CN to US).

- ③ A big American firm requests for a brokerage as a 1:1 IP-Exchange (US to JP).

- IOU activates the brokerage process in sequence of Korea, China, and America by grouping three requests. Finally IOU connects the outgoing of US firm to a big incoming-specialized Japanese firm.

- Eventually, a big Japanese firm without paying any expense obtains a reflective income originated from a small Korean firm in the blind spot. IOU lets the big Japanese firm and the small Korean firm share the reflective profit. [Hot Issue]

IOU supports small IP firms by a unique method, utilizing their outgoing applications for new profit.

Recently joined members

| R*********** | hwa*** | AT |

| L*********** | hwa*** | BR |

| P*********** | and*** | CU |

| U*********** | ask*** | GB |

| W*********** | sky*** | HU |